1. Industry Definition & Scope

The Vehicle Equipment Industry encompasses the design, manufacturing, distribution, and sale of all non-consumable components, systems, accessories, and tools used in the manufacturing, maintenance, repair, operation, and enhancement of motor vehicles. It serves the entire vehicle lifecycle from the assembly line to the scrapyard, spanning both the OEM (Original Equipment Manufacturing) market and the aftermarket. This industry is a critical pillar of the global automotive ecosystem, driven by technological innovation, safety regulations, and consumer preferences.

2. Major Product Categories

-

By Value Chain Segment:

-

OEM Equipment (Tier 1, 2, 3 Suppliers): Components and systems supplied directly to vehicle manufacturers for new vehicle assembly.

-

Powertrain: Engines, transmissions, turbochargers, fuel systems, exhaust systems.

-

Chassis & Safety: Braking systems (ABS, ESC), steering systems, suspension, airbags, seat belts, ADAS sensors (radar, cameras, LiDAR).

-

Electronics & Interior: Infotainment systems, instrument clusters, wiring harnesses, seats, climate control, lighting.

-

Exterior: Body panels, bumpers, glass, mirrors, wheels.

-

-

Aftermarket Equipment: Products sold for vehicle repair, replacement, maintenance, or customization after the initial sale.

-

Repair & Maintenance Parts: Brake pads, filters, batteries, spark plugs, belts, wiper blades.

-

Collision Parts: Bumpers, fenders, headlights, windshields (from OEMs and independent suppliers).

-

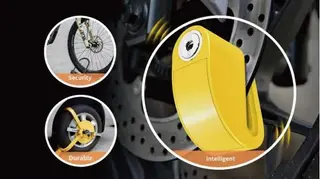

Performance & Customization: Tires, alloy wheels, suspension kits, exhaust systems, aesthetic trims.

-

Accessories & Comfort: Roof racks, floor mats, seat covers, navigation/GPS units, dash cams, phone mounts.

-

Tools & Shop Equipment: Diagnostic scanners, lifts, tire changers, hand tools for professional workshops and DIY enthusiasts.

-

-

-

By Vehicle Type:

-

Passenger Cars

-

Light Commercial Vehicles (LCVs)

-

Heavy-Duty Trucks & Buses

-

Off-Highway & Agricultural Vehicles

-

Motorcycles & Powersports

-

-

By Technology Focus:

-

Conventional Powertrain Equipment

-

Electric Vehicle (EV) & Hybrid Equipment: Batteries, electric motors, inverters, onboard chargers, thermal management systems.

-

Connected & Autonomous Vehicle (CAV) Equipment: V2X communication modules, high-performance computing units, advanced sensor suites.

-

Advanced Safety & Driver-Assist Systems

-

3. Industry Chain Structure

Upstream:

-

Raw Material & Basic Input Suppliers: Steel, aluminum, plastics, rubber, glass, semiconductors, rare earth metals.

-

Specialized Component Makers: Producers of microchips, bearings, seals, fasteners, displays.

Midstream:

-

Integrated System Suppliers (Tier 1): Global giants like Bosch, Continental, Denso, Magna, ZF. They design and integrate complex systems (e.g., entire brake or infotainment systems) for OEMs.

-

Component & Module Suppliers (Tier 2/3): Supply specific parts (e.g., a single sensor, motor) to Tier 1s or directly to smaller OEMs.

-

Independent Aftermarket (IAM) Manufacturers: Companies specializing in replacement parts and accessories, competing with OEM genuine parts (e.g., NGK for spark plugs, Bilstein for shocks).

-

Tool & Equipment Manufacturers: Snap-on, Bosch Diagnostics, etc.

Downstream:

-

Vehicle Manufacturers (OEMs): Integrate equipment into final vehicles.

-

Distribution Channels:

-

OEM-Specific: Captive parts distribution through dealer networks.

-

Aftermarket: Multi-brand distributors (e.g., AutoZone, NAPA in the US; LKQ in Europe), wholesalers, and online retailers (e.g., Amazon, RockAuto).

-

-

Installation & Service Points:

-

OEM-Authorized Dealerships

-

Independent Repair Shops & Garages

-

Fast-Fit Chains (e.g., Midas, Kwik Fit)

-

DIY Consumers

-

-

End Users: Vehicle owners, fleet operators, repair technicians.

4. Key Market Dynamics & Characteristics

-

Technology-Driven Disruption: The shift to electrification, connectivity, and autonomy is radically reshaping the product portfolio, forcing suppliers to invest heavily in new competencies.

-

Stringent Regulatory Environment: Global emissions standards (Euro 7, China 6), safety regulations (NCAP), and cybersecurity mandates dictate product development.

-

Cyclicality Tied to Vehicle Production: OEM equipment demand closely follows the boom-and-bust cycles of new vehicle sales.

-

Counter-Cyclical Aftermarket: Maintenance and repair demand remains more stable, often increasing during economic downturns as people keep cars longer.

-

Intense Cost Pressure & Globalization: OEMs demand annual price reductions, pushing manufacturing to low-cost regions and driving industry consolidation.

-

Rise of "Software-Defined Vehicles": Value is shifting from pure hardware to software and electronic architecture, creating new players (e.g., tech companies) and new revenue models (e.g., OTA updates, feature-on-demand).

5. Development Trends

-

Electrification & New Powertrain Architectures:

-

Exponential growth in demand for batteries, e-motors, and power electronics. Decline in traditional engine and transmission components.

-

Need for specialized equipment for EV maintenance (high-voltage system safety, battery diagnostics).

-

-

Software & Electronics Dominance:

-

Vehicles as "computers on wheels." Increased content of semiconductors, ECUs, and sensors.

-

Centralized E/E Architectures replacing distributed systems, changing the role of Tier 1 suppliers.

-

-

ADAS & Autonomous Driving Progression:

-

Rapid adoption of L2/L2+ ADAS, driving demand for cameras, radars, and ultrasonic sensors.

-

Development towards higher autonomy (L3/L4), requiring LiDAR, high-precision maps, and AI computing platforms.

-

-

Sustainability & Circular Economy:

-

Use of lightweight materials (composites, aluminum) to improve efficiency.

-

Focus on remanufactured parts and recyclability of components, especially EV batteries.

-

-

Digitalization of Distribution & Service:

-

Growth of e-commerce for parts and accessories.

-

Predictive maintenance using vehicle data to anticipate part failures and optimize inventory.

-

6. Major Challenges & Opportunities

Challenges:

-

Technological Obsolescence & High R&D Costs: The pace of change risks making existing product lines obsolete.

-

Margin Squeeze: Caught between OEM cost pressure and rising material/ R&D costs.

-

Supply Chain Fragility: Vulnerability to disruptions in semiconductor and raw material supply.

-

Talent Gap: Shortage of engineers with expertise in software, data, and EV technologies.

-

Competition from New Entrants: Tech companies (e.g., Nvidia, Qualcomm, Huawei) entering the automotive space.

Opportunities:

-

Growth in EV and CAV Segments: Creating entirely new, high-value product categories.

-

Aftermarket for Aging Vehicle Parks: As vehicles become more complex and last longer, specialized repair equipment and training become critical.

-

Data-Driven Services: Monetizing vehicle data through predictive maintenance, usage-based insurance, and personalized services.

-

Emerging Markets: Growth in vehicle ownership in Asia, Africa, and South America driving demand for both OEM and aftermarket equipment.

-

Consolidation & Specialization: Opportunities for niche suppliers with leading-edge technology in specific domains (e.g., LiDAR, battery management systems).