1. Industry Definition & Scope

The Slippers Industry encompasses the design, manufacturing, distribution, and retail of footwear specifically intended for indoor or casual use, characterized by an open-back construction for easy slip-on/off. It serves a dual purpose of providing foot protection, hygiene, and comfort within domestic, hospitality, and institutional environments, while also evolving as a fashion accessory within the loungewear and athleisure categories.

2. Major Product Categories

1. By Primary Material

-

Fabric & Pile Slippers: Made from materials like cotton, terry cloth, velour, microfiber, and faux fur. Often lined and padded for warmth (e.g., winter booties).

-

Foam & Polymer Slippers: Utilizing EVA (Ethylene-Vinyl Acetate), memory foam, PVC, or rubber. Includes lightweight scuffs, clogs (e.g., "Crocs"-style), and molded sandals. Dominant in bathroom and spa settings.

-

Leather & Synthetic Leather Slippers: Offering a more structured, durable, and dress-casual appearance, often mimicking mules or loafers.

-

Natural Material Slippers: Incorporating wool (felted or knitted), cork, wood, or bamboo for specific aesthetics, breathability, or eco-appeal.

2. By Function & Use Case

-

Comfort/Everyday Slippers: Designed for general home wear, prioritizing softness, warmth, and cushioning.

-

Bath & Spa Slippers: Water-resistant, quick-drying, and feature non-slip soles. Often disposable or made from rubber/EVA.

-

Hospitality Slippers: Supplied by hotels, airlines, and spas. Typically lightweight, disposable (non-woven fabric/terry cloth), or basic reusable models.

-

Recovery & Medical Slippers: Designed with features like adjustable closures, extra-wide fits, heel protection, and rigid soles for post-surgery or mobility assistance.

-

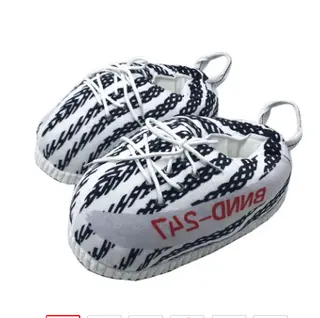

Fashion & Outdoor-Crossover Slippers: Blurring lines with sandals or mules, suitable for brief outdoor use (e.g., retrieving mail, patio). Emphasize design trends, colors, and materials.

3. By Consumer Segment

-

Adults (Men/Women/Unisex): The core market, with segmentation by style, color, and size.

-

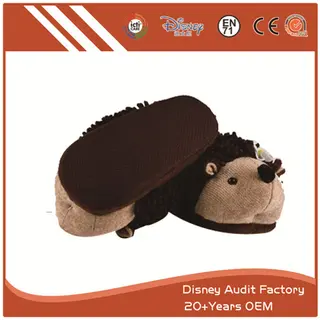

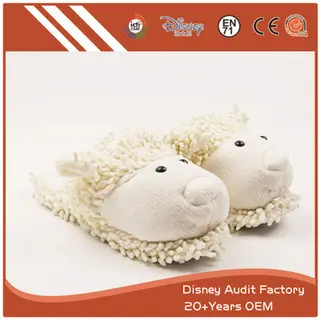

Children & Infants: Focus on safety (non-slip soles, secure fit), playful designs, and often machine-washable materials.

-

Specialty Markets: Including maternity slippers (with support), diabetic slippers (seamless interiors, protective design), and heated slippers for extreme cold.

3. Industry Chain Structure

Upstream:

-

Raw Material Suppliers: Producers of textiles, synthetic fibers, leather, rubber, EVA/polymer compounds, memory foam, and adhesives.

-

Component Manufacturers: Makers of soles, insoles, non-slip coatings, trims (bows, beads), and packaging.

Midstream:

-

Design & Product Development: In-house teams or independent designers creating seasonal collections.

-

Manufacturers & OEMs/ODMs:

-

Large-scale factories (often in Asia) producing for global brands.

-

Specialized workshops for handcrafted or premium segments.

-

-

Quality Control & Compliance Testing: Ensuring adherence to safety (slip resistance, flammability), performance, and chemical standards (e.g., REACH, CPSIA).

Downstream:

-

Brand Owners: Ranging from global conglomerates and fashion houses to niche DTC (Direct-to-Consumer) brands.

-

Distributors & Wholesalers: Serving B2B markets like hotels, hospitals, and corporate gifts.

-

Retail Channels:

-

Mass Merchandisers & Department Stores: For volume sales of basic to mid-range products.

-

Specialty Stores & Boutiques: For premium, design-focused, or therapeutic products.

-

E-commerce Platforms: A dominant channel offering vast selection and convenience (Amazon, brand websites, etc.).

-

-

End Consumers & Institutional Buyers: Households, hotels, healthcare facilities, corporations.

4. Key Market Dynamics & Characteristics

-

Seasonality: Strong demand peaks in Q4 (holiday gifting, winter) and Q3 (back-to-school, seasonal refresh).

-

Disposable vs. Durable Segment: Split between low-cost, frequently replaced items (hospitality, basic home use) and premium, longer-lasting purchases.

-

Fashion Influence: Increasingly influenced by broader footwear and apparel trends (colors, textures, minimalist vs. ornate styles).

-

Commodity vs. Differentiated Competition: Intense price competition at the low end vs. brand, design, technology, and marketing-driven competition at the mid-high end.

5. Development Trends

-

Premiumization & Wellness Focus:

-

Growth in products featuring ergonomic support (arch, heel), therapeutic materials (memory foam, gel, infrared), and health-oriented features (antibacterial linings, odor control).

-

-

Sustainability:

-

Use of recycled materials (PET bottles, rubber), bio-based polymers, and natural, biodegradable fibers.

-

Initiatives for product longevity, repairability, and take-back/recycling programs.

-

-

Smart Features & Personalization:

-

Integration of heated elements (battery/USB), step-tracking sensors, and temperature regulation.

-

Growth of customization options (monogramming, color choices).

-

-

Blurring of Categories:

-

Slippers designed for "indoors-outdoors" use with more durable soles.

-

Fashion-forward designs that can be worn as casual outerwear (e.g., designer mules, luxury slides).

-

-

Direct-to-Consumer (DTC) & Digital Marketing:

-

Rise of digitally-native brands using social media marketing, influencer partnerships, and data-driven design to reach consumers.

-

6. Major Challenges & Opportunities

Challenges:

-

Low Barriers to Entry & Price Sensitivity: Leads to market saturation and thin margins for undifferentiated products.

-

Supply Chain Volatility: Dependence on petrochemicals (for synthetics) and global logistics exposes the industry to cost and disruption risks.

-

Fast Fashion & Overconsumption: Contributes to environmental waste; pressure to reduce ecological footprint.

-

Counterfeit Products: Particularly for branded or designer styles.

Opportunities:

-

Aging Populations: Rising demand for comfortable, supportive, and easy-to-wear footwear in developed economies.

-

Growth of Home-Centric Lifestyles ("Homebody Economy"): Increased time spent at home post-pandemic boosts demand for quality loungewear and home comfort products.

-

E-commerce Expansion: Enables global reach for niche brands and facilitates direct customer relationships.

-

Innovation in Materials & Technology: Opportunity to create high-value products through functional and sustainable advancements.

-

Emerging Markets: Rising disposable incomes in developing regions drive market expansion for basic and aspirational products.