Industry Definition & Scope

The solar energy systems industry encompasses the complete value chain of designing, engineering, integrating, installing, commissioning, operating, and maintaining comprehensive energy solutions that convert sunlight into usable energy forms. Unlike standalone component manufacturing, this industry focuses on delivering turnkey systems solutions that combine solar generation technology with energy management, storage, and grid integration capabilities. It serves residential, commercial, industrial, and utility-scale markets with integrated energy packages.

Key System Categories

By System Configuration & Function:

-

Grid-Tied Solar Systems: Systems connected to the public electricity grid without battery storage, designed to offset consumption and export surplus power under net metering or feed-in tariff arrangements.

-

Hybrid Solar Systems (Solar-Plus-Storage): Systems integrating solar PV with battery energy storage (BESS), enabling self-consumption optimization, backup power during outages, and advanced grid services like peak shaving.

-

Off-Grid Solar Systems: Fully independent power systems providing electricity in locations without grid access, typically combining solar PV, battery storage, and often backup generators.

-

Solar Thermal Systems: Complete installations for heating applications, including solar water heating systems (for domestic or commercial hot water) and solar space heating/cooling systems.

-

Microgrids with Solar Integration: Localized energy grids that can operate independently from the main grid, incorporating solar PV as a primary or complementary generation source alongside storage and other distributed energy resources.

-

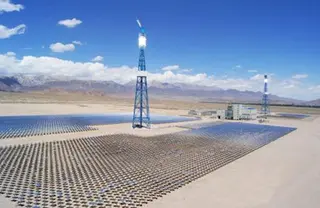

Utility-Scale Solar Power Plants: Large-scale installations (typically >1MW) designed for bulk electricity generation and supply to the grid, including fixed-tilt, single-axis tracking, and concentrated solar power configurations.

By Application Scale & Market:

-

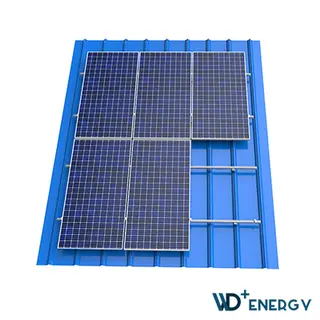

Residential Solar Systems: Rooftop or ground-mounted systems for single-family homes, typically ranging from 3kW to 20kW, including options for backup power.

-

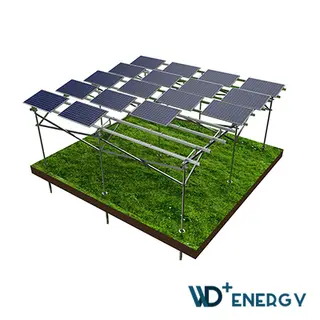

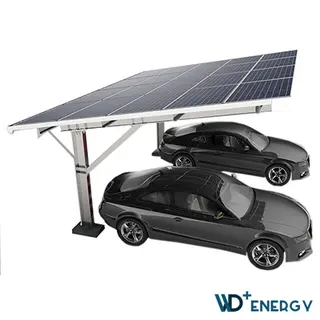

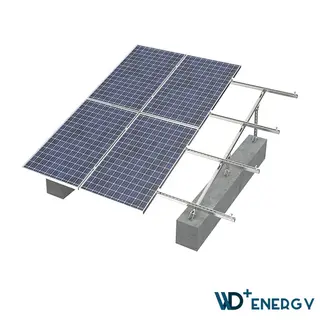

Commercial & Industrial Systems: Larger rooftop, carport, or ground-mounted installations for businesses, factories, and institutions, typically ranging from 20kW to several megawatts.

-

Community Solar & Virtual Power Plants: Shared solar arrangements where multiple participants benefit from a single solar array, and aggregated distributed systems operated as a unified resource for grid support.

-

Agricultural & Water Management Systems: Solar-powered irrigation systems, livestock water pumping, and crop drying applications.

-

Mobile & Portable Solar Systems: Compact, deployable systems for emergency response, military operations, remote research, and recreational vehicles.

Technology & System Integration Trends

-

Advanced Energy Management Systems: AI-driven platforms that optimize energy flows between solar generation, storage, consumption, and the grid in real-time based on weather forecasts, electricity prices, and usage patterns.

-

Smart Inverter & Grid-Forming Technology: Inverters with advanced grid-support functions (voltage/frequency regulation, fault ride-through) enabling higher solar penetration and grid stability.

-

Modular & Pre-Engineered System Design: Standardized, scalable system architectures (like "solar skids") that reduce installation time and costs while improving reliability.

-

Digital Twin & Virtual Commissioning: Use of digital replicas of physical systems for design optimization, performance simulation, and remote troubleshooting.

-

Bifacial Modules with Tracking Integration: Combined use of bifacial panels with single-axis trackers to maximize energy yield through dual-side generation and sun-tracking.

-

Hydrogen-Ready System Design: Future-proofing large-scale solar installations with provisions for coupling with electrolyzers to produce green hydrogen.

Global Market Drivers

-

Falling Total System Costs: Continued reduction in hardware costs combined with installation efficiency gains makes solar systems increasingly economically viable.

-

Corporate & Industrial Decarbonization Goals: Growing demand from businesses for on-site solar systems to meet sustainability targets and reduce energy costs.

-

Government Incentive Programs: Tax credits, rebates, accelerated depreciation, and favorable financing options that improve system economics.

-

Increasing Electricity Prices & Price Volatility: Making solar systems attractive for long-term cost hedging and budget predictability.

-

Grid Modernization Initiatives: Utility and regulatory support for distributed energy resources that enhance grid resilience and defer infrastructure upgrades.

-

Energy Access Initiatives: Programs expanding solar system deployment in underserved and off-grid regions globally.

Industry Value Chain

-

System Design & Engineering Firms: Companies specializing in site assessment, system design, permitting, and performance modeling.

-

Component Manufacturers: Producers of panels, inverters, racking, batteries, and other balance-of-system components.

-

System Integrators & EPC Contractors: Firms responsible for engineering, procurement, and construction of complete solar installations.

-

Financing & Ownership Entities: Banks, funds, and specialized financiers providing capital for system acquisition through loans, leases, or power purchase agreements.

-

Installation & Service Providers: Licensed contractors and technicians performing physical installation, commissioning, and maintenance.

-

Monitoring & Operations Management: Providers of software and services for performance monitoring, preventive maintenance, and asset optimization.

-

End Users & Off-Takers: Homeowners, businesses, utilities, and communities that consume the generated energy or host the systems.

Key Industry Challenges

-

Interconnection Delays & Grid Capacity Limits: Bottlenecks in the grid connection process and limited hosting capacity on distribution networks slowing deployment.

-

Skilled Labor Shortage: Insufficient trained installers, electricians, and engineers to meet rapid market growth demands.

-

Regulatory & Policy Uncertainty: Changes in net metering rules, incentive programs, and permitting requirements creating market instability.

-

Supply Chain Disruptions: Volatility in component availability and pricing affecting project timelines and economics.

-

Cybersecurity Risks: Increasing vulnerability of connected solar systems to cyberattacks as digitalization advances.

-

Fire Safety & Electrical Standards Compliance: Ensuring system safety throughout the lifecycle amid evolving codes and standards.

Future Outlook

The solar energy systems industry is evolving toward intelligent, integrated energy ecosystems.

-

Holistic Energy Solutions: Systems will be increasingly sold as comprehensive "energy-as-a-service" packages combining generation, storage, management, and financing.

-

Grid-Interactive Efficient Buildings: Deep integration of solar systems with building energy management, EV charging, and smart appliances to create optimized energy nodes.

-

Blockchain-Enabled Peer-to-Peer Energy Trading: Platforms allowing direct solar energy trading between producers and consumers within local communities.

-

Predictive & Prescriptive Maintenance: Advanced analytics and machine learning moving from monitoring to predicting failures and prescribing optimal maintenance actions.

-

Standardization & Mass Customization: Industry-wide standardization of components and interfaces enabling faster, lower-cost customized system deployment.

-

Circular Economy Integration: Design for disassembly, reuse, and recycling becoming integral to system design and end-of-life management.

-320x320.webp)