1. Industry Definition & Scope

The Packaging Boxes Industry is a specialized sub-sector of the broader packaging industry, focused on the design, engineering, manufacturing, and distribution of pre-formed, rigid, or semi-rigid container solutions primarily made from paperboard, corrugated fiberboard, and related materials. These boxes serve as the primary or secondary packaging for countless products, providing protection, branding, information display, and logistical functionality across the retail, e-commerce, food & beverage, electronics, and luxury goods sectors.

2. Major Product Categories

-

By Material & Structure:

-

Corrugated Boxes (Brown Boxes): Made from fluted corrugated sheets sandwiched between liners. The workhorse of shipping and industrial packaging.

-

Single-wall, Double-wall, Triple-wall for varying strength needs.

-

Regular Slotted Container (RSC), Full Overlap Container (FOL), Die-cut boxes with custom shapes.

-

-

Folding Cartons (Paperboard Boxes): Made from solid bleached sulfate (SBS), coated unbleached kraft (CUK), or recycled paperboard. Used for consumer product packaging (e.g., cereal, cosmetics, pharmaceuticals, toys).

-

Tray and Lid, Reverse Tuck, Straight Tuck, Glue-End styles.

-

-

Rigid/Setup Boxes: Pre-assembled, non-collapsible boxes made from thick paperboard, often with high-end finishes. Used for luxury goods (jewelry, electronics, perfumes), gifts, and high-value retail.

-

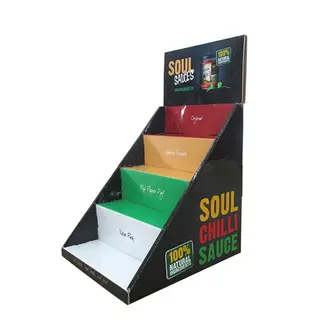

Display Boxes & Point-of-Purchase (POP) Units: Combine packaging with merchandising, designed for shelf impact (e.g., counter displays, blister card backings).

-

-

By Function & End-Use:

-

Shipping & Distribution Boxes: Optimized for protection and cost-effective logistics (primarily corrugated).

-

Retail & Primary Packaging Boxes: Focused on shelf appeal, brand storytelling, and product protection (folding cartons, rigid boxes).

-

Food & Beverage Boxes: Including pizza boxes, bakery boxes, frozen food cartons, beverage carriers. May have special coatings for grease resistance or moisture barriers.

-

E-commerce Fulfillment Boxes: Designed for single-item shipping, easy assembly, efficient packing, and a positive "unboxing experience." Often feature branded printing.

-

Industrial & Bulk Boxes: Heavy-duty for bulk parts, automotive components, or produce.

-

3. Industry Chain Structure

Upstream:

-

Raw Material Suppliers: Pulp and paper mills producing linerboard and corrugating medium for corrugated; paperboard mills for folding carton stock.

-

Ink, Adhesive & Coating Suppliers: Providers of printing inks, glues, and functional coatings (e.g., aqueous coatings, UV coatings, laminates).

Midstream (Converters & Manufacturers):

-

Corrugators: Plants that combine liner and medium to produce corrugated sheets, which are then printed, die-cut, and folded into boxes.

-

Folding Carton Converters: Companies that print, die-cut, and glue flat paperboard into finished cartons.

-

Rigid Box Manufacturers: Specialized facilities assembling and finishing setup boxes.

-

Specialty Die-Cutters & Finishers: Provide complex shaping, embossing, foil stamping, and window patching services.

-

Digital Print Service Providers: Specialize in short-run, customized box production.

Downstream:

-

Brand Owners & Product Manufacturers: The primary customers across all consumer and industrial sectors.

-

Third-Party Logistics (3PL) & E-commerce Fulfillment Centers: Major purchasers of standardized shipping boxes.

-

Retailers & Distributors.

-

Packaging Design Agencies: Create structural and graphic designs.

-

End Consumers: Ultimately interact with the box during unboxing and disposal.

4. Key Market Dynamics & Characteristics

-

Growth Tied to Consumer Spending & E-commerce: Directly correlated with retail sales and the explosive growth of online shopping, which drives demand for both shipping boxes and branded e-commerce packaging.

-

Commodity vs. Value-Added Segments: Intense price competition in standard brown shipping boxes vs. higher-margin opportunities in customized, printed, and structurally innovative retail boxes.

-

Short-Run & On-Demand Trend: Demand for smaller batch sizes, versioning, and rapid turnaround is rising, fueled by DTC brands and agile marketing, favoring digital printing.

-

Sustainability as a Central Driver: Immense pressure to use recycled content, design for recyclability, reduce material usage (lightweighting), and offer reusable solutions. Consumer and regulatory focus is intense.

-

Balancing Protection vs. Cost: Constant engineering challenge to provide adequate product protection while minimizing material and shipping costs.

5. Development Trends

-

E-commerce Optimization & "Unboxing" Focus:

-

Right-sized/On-Demand Box Making Systems in fulfillment centers to eliminate wasted void space.

-

Branded E-commerce Boxes with high-quality printing and designs that create a memorable customer experience.

-

Easy-Open and Re-closable Features improving functionality.

-

-

Sustainable Materials & Circular Design:

-

Increasing use of post-consumer recycled (PCR) fiber and forest-certified virgin fiber.

-

Growth of molded pulp inserts as a sustainable alternative to plastic foams.

-

Design for Disassembly: Easily separable materials (e.g., removing plastic windows or tape) to improve recycling streams.

-

Reusable Packaging Systems: Pilots for returnable/refillable box systems in specific sectors.

-

-

Digital Printing & Mass Customization:

-

Adoption of high-speed digital presses for corrugated and cartons enabling cost-effective short runs, variable data, and personalization.

-

Web-to-Pack Platforms: Online portals for customers to design, prototype, and order custom boxes directly.

-

-

Smart & Connected Packaging Integration:

-

Incorporation of QR codes, NFC tags, and augmented reality (AR) triggers printed directly on boxes for supply chain transparency, authentication, and interactive consumer engagement.

-

-

Structural Innovation & Automation:

-

Advanced CAD/CAM software for creating complex, space-efficient, and protective structures.

-

Robotics and automated packaging lines for box erection, packing, and sealing to combat labor shortages.

-

6. Major Challenges & Opportunities

Challenges:

-

Volatile Raw Material (Paper) Costs: Fluctuations in OCC (old corrugated containers) and pulp prices directly impact profitability.

-

Rising Sustainability Compliance Costs: Investment required in new materials, equipment, and certification processes.

-

Intense Competition & Price Pressure: Especially in the commoditized corrugated shipping box segment.

-

Skilled Labor Shortage: Need for operators proficient in running complex digital and converting equipment.

-

Logistics & "Empty Space" Inefficiency: High cost of transporting air due to poorly sized boxes in e-commerce.

Opportunities:

-

E-commerce as a Permanent Growth Driver: Continuous innovation in fulfillment packaging is a massive, sustained opportunity.

-

Brands Investing in Packaging Experience: Willingness to pay a premium for boxes that enhance brand perception and customer loyalty.

-

Replacement of Problematic Materials: Box solutions replacing single-use plastics in retail and food service (e.g., clamshells, blister packs).

-

Digital Transformation Lead: Early adopters of digital printing and online ordering platforms can capture the growing DTC and short-run market.

-

High-Value Niche Markets: Luxury packaging, experiential unboxing, and specialized protective packaging for electronics/medical devices offer higher margins.