Industry Definition & Scope

The control valves industry encompasses the design, manufacturing, and application of specialized valves used to regulate and manipulate the flow, pressure, temperature, or level of process fluids (liquids, gases, slurries) within industrial systems. These are critical final control elements in automated process control loops, responding to signals from controllers to precisely adjust fluid conditions. The industry serves essential functions in process industries where precise fluid handling is paramount for safety, efficiency, and product quality.

Key Product Categories

By Valve Type & Design:

-

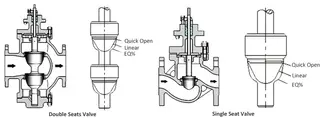

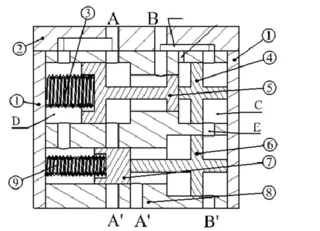

Globe Valves: Most common type, with a linear motion stem and plug/seat design, offering excellent throttling control and shut-off capability.

-

Rotary Valves (Ball, Butterfly, Eccentric Plug): Feature quarter-turn operation; ball valves offer tight shut-off, butterfly valves are compact for large lines, and eccentric plug valves handle slurries well.

-

Diaphragm Valves: Use a flexible diaphragm to isolate the flow stream from the actuator, ideal for corrosive, abrasive, or sterile fluids.

-

Angle Valves & 3-Way Valves: Special configurations for directional flow changes or mixing/diverting services.

-

Cryogenic & High-Temperature Valves: Engineered for extreme temperature applications.

-

Pressure Relief & Safety Valves: A related category that automatically releases pressure to protect systems, though often classified separately.

By Actuation Method:

-

Pneumatic Actuators: Most prevalent, using compressed air for reliable, fast response. Types include diaphragm, piston, and rack-and-pinion.

-

Electric Actuators: Use electric motors, suitable for locations without compressed air, offering precise positioning.

-

Hydraulic Actuators: Use hydraulic fluid for very high torque/thrust applications.

-

Electro-Hydraulic Actuators: Combine electric control with hydraulic power.

-

Manual Overrides: Incorporated for emergency or backup operation.

By Size, Pressure, & Temperature Rating:

-

Size Range: Typically from ½ inch (DN15) to over 24 inches (DN600) or larger for special applications.

-

Pressure Classes: From vacuum service to ANSI Class 2500 (or higher) for ultra-high pressure.

-

Temperature Range: From cryogenic (below -196°C) to high-temperature services exceeding 800°C.

Technology & Innovation Trends

-

Digitalization & Smart Valves: Integration of digital positioners, sensors, and microprocessors enabling diagnostics, performance data (e.g., valve signature, health status), and two-way communication via fieldbus protocols (Foundation Fieldbus, PROFIBUS, HART).

-

Advanced Materials & Coatings: Use of super alloys (Hastelloy, Inconel), ceramics, engineered polymers, and specialized hard/soft coatings to combat corrosion, erosion, and wear in harsh services.

-

Low-Emission & Fugitive Emission Designs: Stringent environmental regulations driving designs with improved stem sealing (e.g., live-loaded packing, bellows seals) to minimize leakage of volatile compounds.

-

Modular & Compact Designs: Space-saving and easier-to-maintain designs, especially for retrofit applications.

-

Integrated Control & Actuation Packages: Pre-engineered, tested combinations of valve, actuator, positioner, and accessories to ensure optimized performance and reduce engineering time.

-

Advanced Diagnostics & Predictive Maintenance: Use of onboard intelligence to monitor friction, seat wear, and packing condition, predicting failure and scheduling maintenance.

Global Market Drivers

-

Process Industry Investment: Capital expenditure in oil & gas (including LNG), petrochemicals, chemicals, and refining drives new valve demand.

-

Aging Infrastructure & Plant Modernization: Replacement and upgrade of existing control valves in older facilities for improved performance and reliability.

-

Stringent Safety & Environmental Regulations: Compliance with standards (e.g., EPA Leak Detection and Repair, SIL ratings for safety systems) mandating high-performance, low-emission valves.

-

Power Generation Transition: Demand from traditional thermal plants, nuclear facilities, and growing investments in hydrogen, CCUS (Carbon Capture, Utilization & Storage), and bioenergy.

-

Water & Wastewater Treatment Growth: Expansion of treatment facilities and smart water networks requiring precise flow control.

-

Pharmaceutical & Food & Beverage Industry Standards: Need for hygienic (sanitary) valves meeting strict cleanliness and sterility requirements (e.g., 3-A, ASME BPE standards).

Industry Value Chain

-

Raw Material & Component Suppliers: Special alloy producers, casting/forging foundries, seal manufacturers, and electronics suppliers.

-

Valve Manufacturers: Companies specializing in design and assembly of complete control valves.

-

Actuator & Accessory Manufacturers: Producers of actuation systems, positioners, solenoid valves, and other ancillary equipment.

-

System Integrators & Engineering Firms: Companies that specify and integrate valves into complete process control systems for end-users.

-

Distributors & Representatives: Channels for sales, inventory, and local technical support.

-

End Users: Operators in oil & gas, chemicals, power generation, water treatment, pharmaceuticals, pulp & paper, and other process industries.

Key Industry Challenges

-

Cyclical Demand: Tied to capital investment cycles in major process industries, leading to market volatility.

-

Intense Global Competition: Pressure from established Western manufacturers, low-cost Asian producers, and regional players.

-

Technical Complexity & Customization: High degree of application engineering required, making it difficult to standardize and scale production.

-

Skilled Labor Shortage: Shortage of experienced application engineers, service technicians, and manufacturing specialists.

-

Price Pressure & Margin Erosion: Especially on standard products, with competition often based on price rather than total cost of ownership.

-

Long Sales Cycles & Project Dependencies: Sales often tied to the timeline of large capital projects, which can be delayed or cancelled.

-

Counterfeit & Substandard Products: Proliferation of imitation valves posing safety and performance risks.

Future Outlook

The control valve industry is evolving towards greater intelligence, connectivity, and lifecycle value.

-

Dominance of IIoT Integration: Valves will become standard nodes in the Industrial Internet of Things, streaming data to cloud platforms for plant-wide optimization.

-

Shift to Services & Outcomes: Business models evolving from product sales to offering performance guarantees, managed services, and predictive maintenance contracts.

-

Advanced Automation & Autonomy: Self-tuning valves and valves capable of autonomous control within defined parameters, reducing control loop complexity.

-

Focus on Total Cost of Ownership: Increased emphasis on energy efficiency (reduced pressure loss), maintenance costs, and lifecycle duration over initial purchase price.

-

Sustainability-Driven Innovation: Development of valves for new energy systems (hydrogen, green fuels) and designs that minimize environmental impact throughout their lifecycle.

-

Supply Chain Digitalization & Additive Manufacturing: Use of digital twins for design/testing and 3D printing for complex parts or spare parts on-demand, reducing lead times.