Industry Definition & Scope

The steel industry encompasses the entire value chain from iron ore mining and coking coal processing to steelmaking, casting, rolling, finishing, and distribution. As a fundamental material of modern civilization, steel serves as the backbone of industrialization, infrastructure, manufacturing, and technological advancement worldwide.

Key Product Categories

-

By Production Process:

-

Blast Furnace-Basic Oxygen Furnace (BF-BOF): Traditional integrated route (≈70% global production)

-

Electric Arc Furnace (EAF): Scrap-based recycling route (≈30% global production)

-

Direct Reduced Iron (DRI): Natural gas/hydrogen-based alternative

-

-

By Product Form:

-

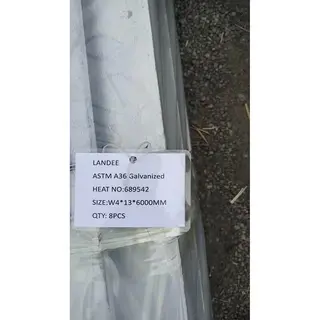

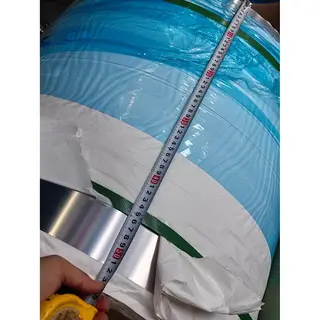

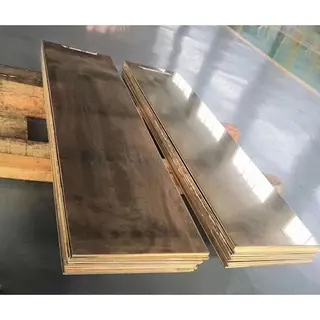

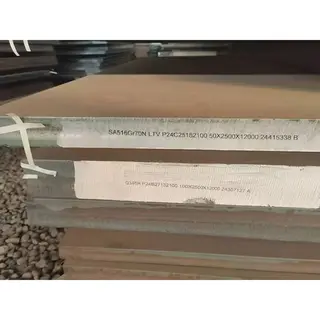

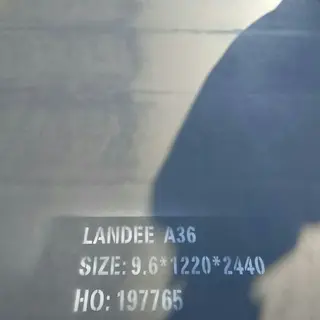

Flat Products: Hot-rolled coils, cold-rolled coils, coated sheets (galvanized, galvalume), plates

-

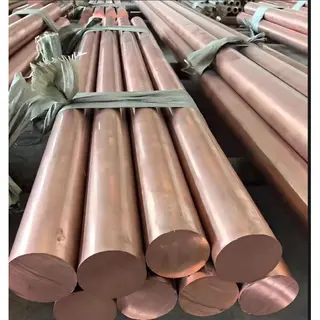

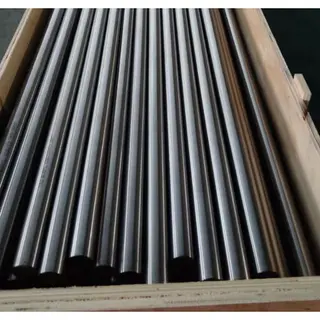

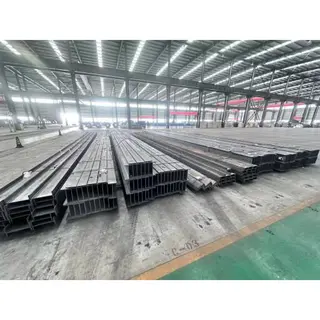

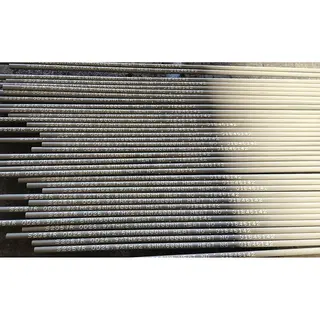

Long Products: Rebar, wire rod, sections (beams, channels, angles), rails, bars

-

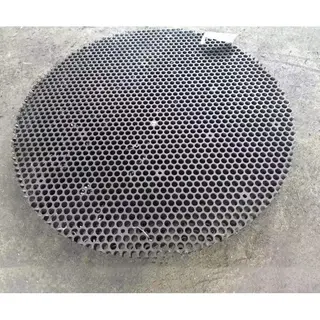

Tubular Products: Seamless and welded pipes (covered separately)

-

Specialty Products: Electrical steel, tool steel, stainless steel, advanced high-strength steel

-

-

By Application Sector:

-

Construction: Structural steel, reinforcement bars (≈50% global consumption)

-

Automotive: Body panels, chassis components, engine parts (≈12% consumption)

-

Machinery & Equipment: Industrial machinery, agricultural equipment

-

Energy: Oil & gas pipelines, wind turbines, power transmission towers

-

Consumer Goods: Appliances, packaging (tinplate), furniture

-

Infrastructure: Bridges, railways, ports, airports

-

Technology & Innovation Trends

-

Green Steel Transition:

-

Hydrogen-based direct reduction (HYBRIT, H2 Green Steel)

-

Carbon capture utilization and storage (CCUS) in BF-BOF routes

-

Biochar and alternative reductant development

-

-

Digital Transformation:

-

Industry 4.0 smart factories with AI-powered process control

-

Digital twins for blast furnace optimization

-

Blockchain for carbon footprint tracking

-

-

Advanced Materials:

-

3rd generation advanced high-strength steels (AHSS)

-

Gradient-structured steels for enhanced performance

-

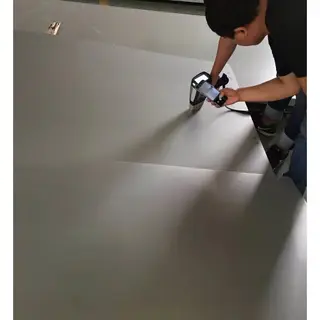

Smart coatings for corrosion resistance

-

-

Circular Economy:

-

Scrap-based EAF expansion

-

Design for disassembly and recycling

-

By-product utilization (slag, dust, gases)

-

Global Market Dynamics

-

Production Centers: China (53% global output), India, Japan, United States, Russia

-

Consumption Drivers:

-

Emerging market urbanization and infrastructure development

-

Global automotive industry electrification transition

-

Renewable energy infrastructure expansion

-

Manufacturing reshoring and supply chain reconfiguration

-

-

Regulatory Landscape:

-

Carbon border adjustment mechanisms (EU CBAM)

-

National decarbonization commitments (China's carbon neutrality by 2060)

-

Trade protections and anti-dumping measures

-

-

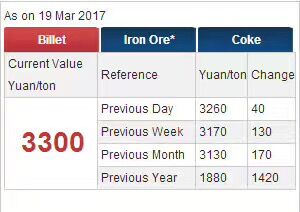

Price Determinants:

-

Iron ore and coking coal prices

-

Scrap metal availability and pricing

-

Energy costs (electricity, natural gas)

-

Geopolitical factors and trade policies

-

Major Players & Value Chain

-

Integrated Giants: China Baowu, ArcelorMittal, Nippon Steel, POSCO, HBIS Group

-

Mini-mill Specialists: Nucor, Steel Dynamics, Commercial Metals (CMC)

-

Regional Leaders: Tata Steel, JFE Steel, ThyssenKrupp, Severstal

-

Value Chain: Mining → Coking → Ironmaking → Steelmaking → Casting → Rolling → Finishing → Distribution → End Users

Challenges & Opportunities

-

Critical Challenges:

-

Decarbonization costs and technology scalability

-

Overcapacity in certain regions

-

Volatile raw material and energy markets

-

Trade tensions and protectionism

-

-

Strategic Opportunities:

-

Green premium products and carbon-neutral steel

-

Advanced manufacturing applications (lightweight vehicles, sustainable construction)

-

Digital service models (predictive maintenance, material certification)

-

Circular economy leadership and scrap ecosystem development

-