Industry Definition & Scope

The lab supplies industry encompasses the manufacturing, distribution, and supply of consumables, equipment, instruments, and reagents used in scientific research, quality control, clinical diagnostics, and educational laboratories. This critical sector supports the entire scientific ecosystem across life sciences, pharmaceuticals, chemicals, academia, healthcare, and industrial R&D. Products range from routine disposable items to highly specialized research tools.

Key Product Categories

By Product Type & Function:

-

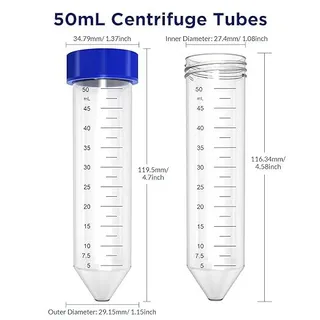

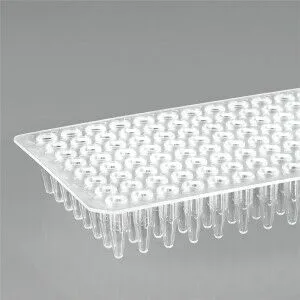

Consumables & Disposables: Pipette tips, microplates, test tubes, centrifuge tubes, petri dishes, sample vials, cryogenic storage vials, gloves, and filtration products.

-

Laboratory Glassware & Plasticware: Beakers, flasks, graduated cylinders, bottles, and plastic containers made from materials like borosilicate glass, polypropylene, and PTFE.

-

General Lab Equipment: Basic instruments such as balances, centrifuges, hot plates/stirrers, pH meters, water purification systems, and vortex mixers.

-

Liquid Handling Equipment: Manual and electronic pipettes, pipette controllers, repeating dispensers, and automated liquid handling workstations.

-

Sample Preparation & Storage: Homogenizers, sonicators, incubators, refrigerators/freezers (including ultra-low temperature), and environmental chambers.

-

Filtration & Separation Products: Syringe filters, membrane filters, chromatography columns, and centrifugation supplies.

-

Safety & Lab Essentials: Fume hoods, biosafety cabinets, eye wash stations, lab coats, protective eyewear, and chemical storage cabinets.

-

Reagents & Chemicals: Buffers, solvents, acids, bases, salts, stains, dyes, cell culture media, sera, and enzymes. Includes both general-purpose and highly specialized research-grade chemicals.

By Application Area:

-

Life Science Research: Cell culture products, molecular biology reagents (PCR kits, enzymes, nucleotides), protein analysis supplies, and microscopy consumables.

-

Clinical/Diagnostic Labs: Supplies for in vitro diagnostics, specimen collection/transport, hematology, microbiology, and histopathology.

-

Chemical Analysis: Supplies for chromatography (HPLC, GC), spectroscopy, and mass spectrometry (vials, columns, standards).

-

Academic & Teaching Labs: Durable and cost-effective supplies for undergraduate and graduate-level education.

-

Industrial/Quality Control: Supplies for raw material testing, product quality assurance, and environmental monitoring.

Technology & Innovation Trends

-

Automation & High-Throughput Solutions: Increased demand for robotic systems, automated liquid handlers, and consumables compatible with automation to improve efficiency and reproducibility.

-

Single-Use & Disposable Technologies: Growth in pre-sterilized, ready-to-use consumables (especially in bioprocessing) to reduce cross-contamination and cleaning validation needs.

-

Sustainability Initiatives: Development of lab products with reduced plastic content, biodegradable alternatives, product take-back programs, and energy-efficient equipment.

-

Digital Integration & Connectivity: Equipment with IoT capabilities for remote monitoring, data logging, and integration with Laboratory Information Management Systems (LIMS) and electronic lab notebooks (ELN).

-

Advanced Materials: Innovations in polymer science for better chemical resistance, lower protein binding, and enhanced clarity in plasticware; development of novel surfaces for cell culture.

-

Miniaturization & Microfluidics: Growing use of lab-on-a-chip technologies and microfluidic devices that reduce reagent consumption and sample volumes.

Global Market Drivers

-

Growth in Life Sciences R&D Spending: Sustained investment from pharmaceutical, biotechnology, and academic research institutions, particularly in areas like genomics, proteomics, and drug discovery.

-

Expansion of Biopharmaceutical Manufacturing: Increasing demand for single-use bioreactors, filtration assemblies, and other process consumables in bioproduction.

-

Rising Clinical Diagnostics Demand: Driven by aging populations, increased disease testing, and personalized medicine.

-

Stringent Regulatory & Quality Standards: Compliance requirements in pharma, food safety, and environmental testing (GMP, GLP, ISO standards) mandating the use of certified, high-quality supplies.

-

Government & Private Funding for Research: Grants and investments supporting basic and applied scientific research globally.

-

Focus on Food Safety & Environmental Monitoring: Increased testing of food products, water, and air quality across industries and governments.

Industry Value Chain

-

Raw Material Suppliers: Providers of specialty plastics, resins, glass, metals, chemicals, and biological materials.

-

Product Manufacturers: Companies specializing in specific categories (e.g., pipette tips, filters, media) or offering broad portfolios.

-

Distributors & Wholesalers: Large-scale suppliers that aggregate products from many manufacturers and provide logistics, inventory management, and procurement services to labs (e.g., Thermo Fisher Scientific, VWR, Avantor).

-

Direct Sales Forces: Manufacturer representatives for specialized, high-value equipment and chemicals.

-

End-User Laboratories: Research institutions, pharmaceutical companies, hospitals, testing facilities, and universities.

Key Industry Challenges

-

High Fragmentation & Intense Competition: The market includes numerous global players and niche specialists, leading to price pressure.

-

Supply Chain Complexity & Vulnerability: Ensuring consistent supply of thousands of SKUs, many with short shelf-lives; vulnerability to disruptions (as seen during the pandemic).

-

Cost Sensitivity in Academic & Budget-Constrained Labs: Pressure to provide high-quality products at lower price points.

-

Rapid Technological Obsolescence: Need for continuous product innovation and portfolio updates to keep pace with evolving research techniques.

-

Stringent Regulatory & Documentation Requirements: Extensive validation, certification, and traceability documentation required, especially for regulated labs.

-

Logistics & Special Handling: Challenges in shipping temperature-sensitive, hazardous, or sterile products globally.

Future Outlook

The lab supplies industry is evolving toward greater specialization, connectivity, and sustainability.

-

Consolidation & Portfolio Expansion: Continued mergers and acquisitions among large players to offer complete, end-to-end workflow solutions.

-

E-commerce & Digital Procurement: Growth of online marketplaces and digital tools that simplify product search, comparison, ordering, and expense management for scientists.

-

Personalized/Customized Solutions: Increased ability to provide labware and reagents tailored to specific research protocols or automated systems.

-

Emerging Market Growth: Significant expansion in Asia-Pacific and other regions with growing research infrastructure and investment.

-

Focus on Lab Efficiency & Data Integrity: Products and systems designed to minimize errors, improve workflow ergonomics, and ensure data traceability for regulatory compliance.

-

Circular Economy Models: Greater emphasis on product recycling, reuse programs, and sustainable sourcing of raw materials.