Industry Definition & Scope

The fasteners industry encompasses the design, manufacturing, and distribution of mechanical devices used to join or affix two or more objects together. This essential industrial sector provides foundational components for virtually every manufacturing and construction activity, from microelectronics to heavy infrastructure. The industry operates across a vast spectrum of materials, sizes, and performance grades, serving as a critical enabler of global industrial production.

Key Product Categories

By Product Type & Function:

-

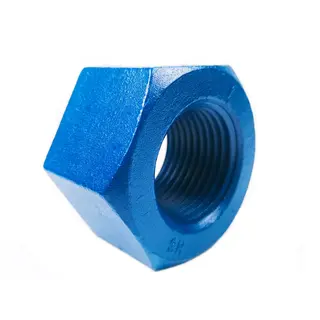

Threaded Fasteners: Bolts, screws, nuts, and studs that utilize helical ridges for joining. This includes standard metric/imperial threads and specialized thread forms.

-

Non-Threaded Fasteners: Pins, rivets, clips, retaining rings, and washers that secure components without threading.

-

Inserts & Anchors: Devices designed to provide threaded reinforcement in softer base materials like plastic, wood, or concrete.

-

Specialty & Engineered Fasteners: Custom-designed fasteners for specific high-stress, high-precision, or unique environmental applications (e.g., aerospace, automotive safety systems).

By Material:

-

Ferrous Fasteners: Made from carbon steel, alloy steel, or stainless steel. Often coated for corrosion resistance.

-

Non-Ferrous Fasteners: Made from aluminum, brass, copper, or titanium, chosen for specific properties like weight, conductivity, or corrosion resistance.

-

Polymer Fasteners: Made from plastics like nylon or PEEK, used for electrical insulation, chemical resistance, or in lightweight applications.

By End-User Industry:

-

Automotive: High-volume, engineered fasteners meeting strict safety and performance standards.

-

Aerospace: Ultra-high-strength, lightweight, and precision fasteners with rigorous certification.

-

Construction & Infrastructure: Large, high-strength bolts, anchors, and fasteners for structural applications.

-

Industrial Machinery & Equipment: Durable fasteners for heavy-duty assembly and vibration resistance.

-

Electronics & Appliances: Miniature and micro-fasteners for precision assembly.

-

Consumer Products: Fasteners for furniture, DIY, and general repair.

Technology & Innovation Trends

-

Smart Fasteners: Integration of sensors or RFID tags into fasteners for monitoring torque, tension, temperature, or for asset tracking.

-

Advanced Coatings & Surface Treatments: Development of nano-coatings, multi-layer plating, and dry lubricants to enhance corrosion resistance, reduce friction, and improve durability.

-

Lightweight & High-Strength Materials: Increased use of advanced alloys, titanium, and composites to reduce weight while maintaining or increasing strength.

-

Additive Manufacturing: 3D printing of custom or complex-geometry fasteners on-demand, especially for prototyping and low-volume specialized applications.

-

Automated Assembly & Driving Systems: Development of fasteners compatible with robotic assembly, including pre-applied adhesives or patch technology.

-

Digital Inventory & Traceability: Use of barcoding, QR codes, and blockchain for full lifecycle traceability from production to installation.

Global Market Drivers

-

Global Manufacturing & Industrial Output: Direct correlation with the health of key sectors like automotive, machinery, and construction.

-

Infrastructure Investment & Construction Activity: Large-scale public and private construction projects driving demand for structural fasteners.

-

Automotive Lightweighting & EV Production: Demand for new fastener solutions to join dissimilar materials (e.g., aluminum to steel) and for battery pack assembly.

-

Renewable Energy Expansion: Wind turbine construction and solar panel mounting creating strong demand for large, high-performance fasteners.

-

Maintenance, Repair, and Operations (MRO): Sustained aftermarket demand across all industrial and commercial facilities.

-

Supply Chain Regionalization: Efforts to build local/regional fastener manufacturing capacity for supply chain resilience.

Industry Value Chain

-

Raw Material Suppliers: Steel mills, non-ferrous metal producers, and chemical suppliers for coatings.

-

Wire Drawing & Forging/Heading: Initial processing of metal into wire or blanks for fastener production.

-

Fastener Manufacturing: Processes including cold heading, thread rolling, heat treating, and surface finishing.

-

Distributors & Wholesalers: Key intermediaries managing vast inventories and providing just-in-time delivery to manufacturers.

-

System Integrators & OEMs: Companies that integrate fasteners into their final products.

-

End Users: Manufacturing plants, construction companies, MRO departments, and consumers.

Key Industry Challenges

-

Global Overcapacity & Price Competition: Intense competition, particularly in standard product segments, leading to margin pressure.

-

Raw Material Price Volatility: Susceptibility to fluctuations in steel, aluminum, and alloy prices.

-

Counterfeiting & Quality Disparity: Significant problem with substandard or counterfeit fasteners that fail to meet specifications, posing safety risks.

-

Skilled Labor Shortage: Shortage of trained personnel for specialized manufacturing, quality control, and technical sales.

-

Complex Logistics & Inventory Management: Managing the enormous variety of SKUs (sizes, materials, grades) efficiently.

-

Meeting Evolving Industry Standards: Keeping pace with increasingly stringent industry-specific standards.

Future Outlook

-

Value Migration to Engineered Solutions: Growth focused on high-value, application-specific fasteners rather than commodity products.

-

Digital Integration with Industry 4.0: Fasteners becoming intelligent data points within connected factories and smart structures.

-

Sustainability & Circular Economy: Increased focus on fastener longevity, recyclability, and manufacturing processes with lower environmental impact.

-

Advanced Joining Solutions: Growth of hybrid systems combining fasteners with adhesives or welding for superior joint performance.

-

Consolidation & Vertical Integration: Continued mergers among manufacturers and distributors to achieve scale, breadth, and supply chain control.