1. Industry Definition & Scope

The Industrial Parts industry is the fundamental backbone of manufacturing, specializing in the design, production, and sale of individual components, units, or modules that constitute final industrial equipment, machinery, vehicles, or systems. While these parts often lack standalone function, they are critical to the performance, reliability, and efficiency of the end product upon assembly and integration. Serving virtually all downstream manufacturing sectors, it is rightfully termed the "food of industry."

2. Major Product Categories

-

Mechanical & Structural Parts

-

Standard Parts: Bolts, nuts, washers, pins, keys, bearings, springs, linear guides, lead screws.

-

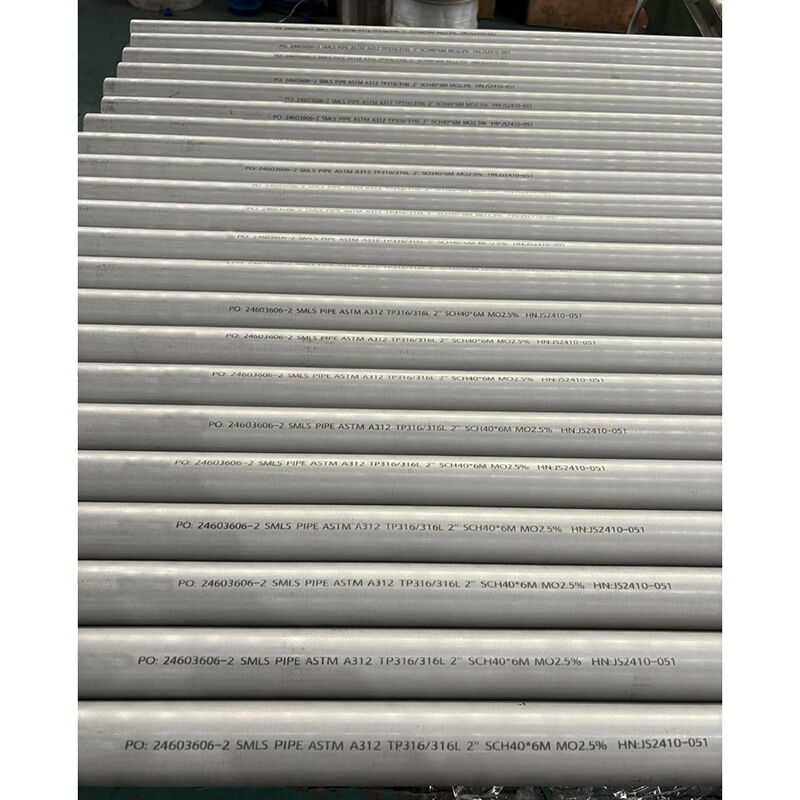

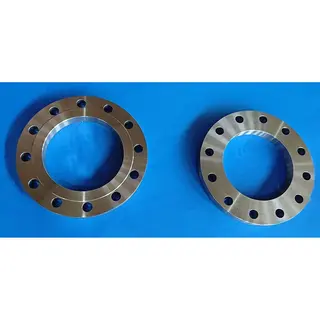

Fabricated Parts: Castings, forgings, sheet metal parts, machined parts (turned, milled, bored), weldments.

-

Power Transmission Parts: Gears, gearboxes, couplings, clutches, pulleys, chains.

-

-

Fluid Power Parts

-

Hydraulic Components: Hydraulic pumps, motors, valves, cylinders, accumulators, tubing.

-

Pneumatic Components: Air compressors, pneumatic valves, cylinders, tubing, filters, regulators.

-

Sealing Components: O-rings, gaskets, oil seals, mechanical seals.

-

-

Electrical & Control Parts

-

Motors & Drives: Servo motors, stepper motors, variable frequency drives (VFDs), gear motors.

-

Sensors & Instruments: Position/pressure/temperature sensors, flow meters, encoders.

-

Industrial Connectivity: Connectors, cables, terminal blocks, relays, switches.

-

-

Core Functional Modules

-

Powertrain Components: Engine parts (pistons, crankshafts), turbine blades, fuel injection systems.

-

Automation Modules: Industrial robot joints, linear motor modules, machine vision lenses/lights.

-

Specialized Components: Wafer chucks/vacuum chambers for semiconductor equipment; main control valves/slewing rings for construction machinery.

-

3. Industry Chain & Business Models

-

Upstream: Raw material suppliers (specialty steel, aluminum alloys, copper, engineering plastics, ceramics), foundational processes (casting, forging, heat treatment).

-

Midstream: Parts manufacturers with diverse models:

-

Standard Parts Producers: Large-scale, standardized manufacturing.

-

Custom/Non-Standard Parts Suppliers: Production based on customer drawings or specifications.

-

Modular System Integrators: Supply pre-assembled functional units.

-

OEM/ODM: Original design or manufacturing for equipment makers.

-

-

Downstream: All equipment manufacturers (OEMs), including end clients in automotive, aerospace, machine tools, robotics, construction machinery, energy equipment, electronics manufacturing, food packaging, etc.

4. Core Characteristics & Barriers

-

High Technical Barriers: Involves interdisciplinary knowledge in materials science, precision machining, thermodynamics, fluid dynamics, and electronic controls.

-

Extreme Reliability Demands: "Zero-defect" or extremely low failure rates are paramount, requiring rigorous testing and certification.

-

Long Certification Cycles: Entering the supply chain of major OEMs involves lengthy quality system audits, sample testing, and low-volume trial phases.

-

Capital & Technology Intensive: Significant investment in advanced manufacturing equipment (e.g., 5-axis CNC machines, vacuum furnaces) and R&D.

-

Strong Customer Stickiness: Once certified and deployed in volume, the cost and risk of switching suppliers are very high, leading to stable partnerships.

5. Development Trends

-

Increasing Precision & Performance: Continuous elevation in requirements for dimensional accuracy, surface finish, and material properties.

-

Smartization & Integration: Parts with embedded sensors and smart diagnostics (e.g., "smart bearings") evolving towards condition monitoring and predictive maintenance.

-

Lightweighting & Green Manufacturing: Adoption of lightweight alloys and composites, with a focus on energy efficiency and environmental sustainability in production.

-

Servitization: Transitioning from purely selling products to offering "Product + Technical Solution + Full Lifecycle Service" packages.

-

Import Substitution: Domestic companies are accelerating technological breakthroughs in high-end segments (e.g., aero-engine blades, high-end machine tool spindles) to replace imports.

6. Key Challenges & Opportunities

-

Challenges:

-

Global supply chain volatility affecting raw material costs and delivery.

-

Shortage of high-end talent, especially cross-disciplinary engineers and senior technicians.

-

Incumbent advantage of international giants in technology and branding.

-

-

Opportunities:

-

Manufacturing Upgrading: Policies like "Made in China 2025" drive demand for high-end foundational components.

-

Emerging Industry Growth: New growth vectors from industries like new energy (wind, solar), electric vehicles, and robotics.

-

Digital Transformation: Leveraging Industrial IoT and Digital Twin technologies to optimize design, production, and supply chain management.

-