1. Industry Definition & Scope

The Bathroom Products Industry is a specialized segment of the broader consumer goods, home improvement, and building materials sectors. It encompasses the design, manufacturing, distribution, and retail of consumer-facing finished goods and accessories specifically for use in bathrooms and washrooms. This industry focuses on the final products that homeowners, designers, and facilities managers select and purchase to create functional, comfortable, and aesthetically pleasing bathroom spaces.

2. Major Product Categories

-

Core Plumbing Fixtures & Fittings:

-

Faucets & Taps: Bathroom sink faucets (widespread, centerset, single-hole), bath fillers, shower systems (mixers, thermostatic valves, digital controls), kitchen faucets (often considered together).

-

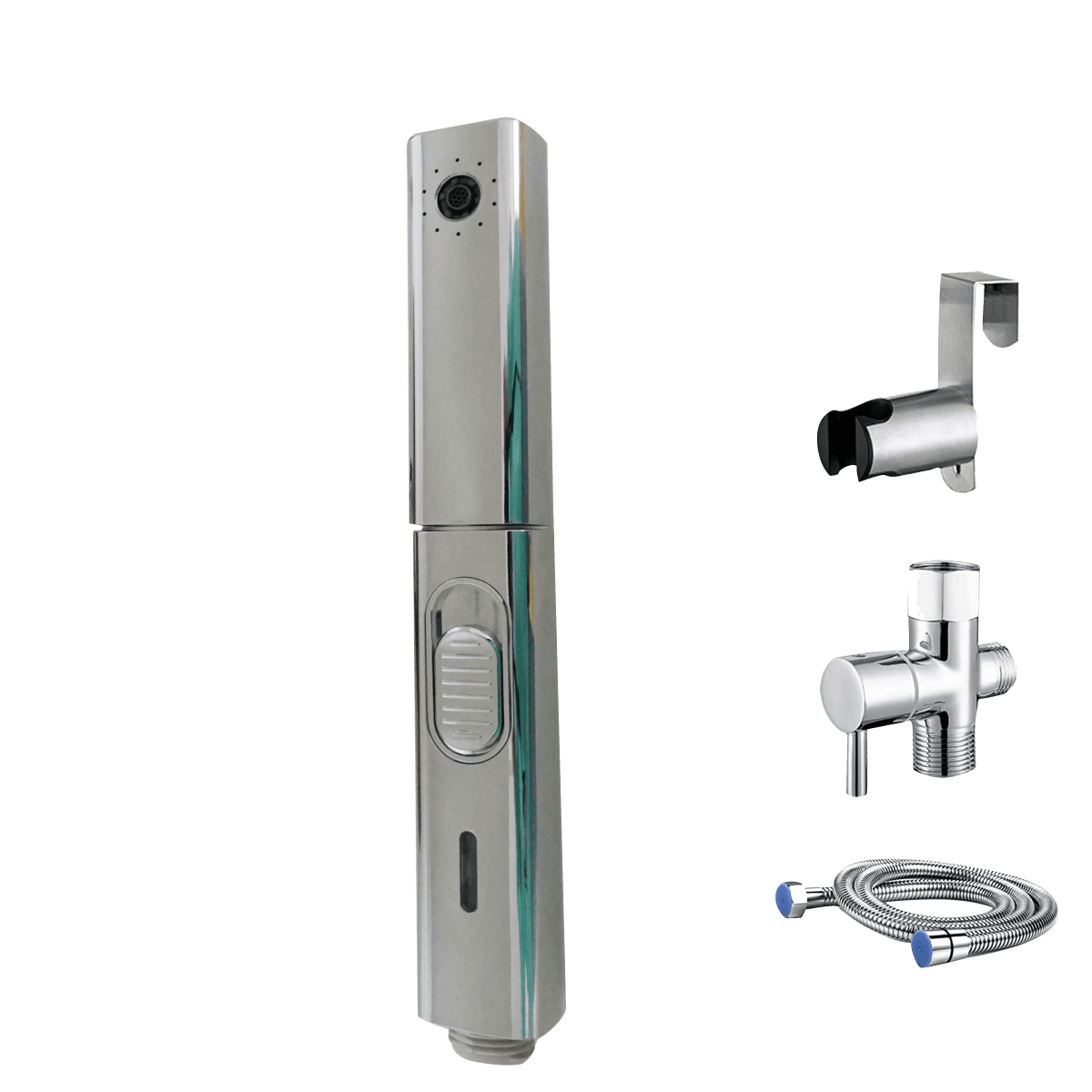

Showering Solutions: Showerheads (rain, handheld, combination), shower arms, shower panels, shower doors and enclosures.

-

-

Bathroom Furnishings & Storage:

-

Vanities & Cabinetry: Bathroom vanity units (with or without tops/sinks), medicine cabinets, wall cabinets, storage towers.

-

Basins/Sinks: Pedestal sinks, undermount sinks, vessel sinks, wall-mounted sinks, integrated vanity tops.

-

-

Bath & Shower Structures:

-

Bathtubs: Alcove tubs, drop-in tubs, freestanding tubs (clawfoot, modern), whirlpool/air tubs.

-

Shower Trays/Bases: Standard and custom sizes, linear drain systems.

-

-

Toilets & Bidets:

-

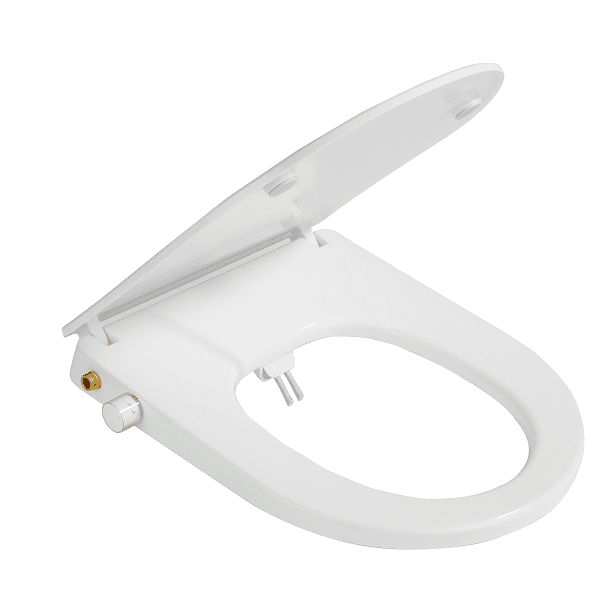

Toilets: Two-piece, one-piece, wall-hung, smart toilets (bidet seats, integrated bidet functions).

-

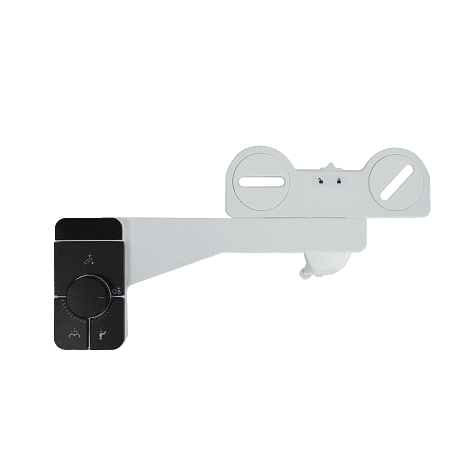

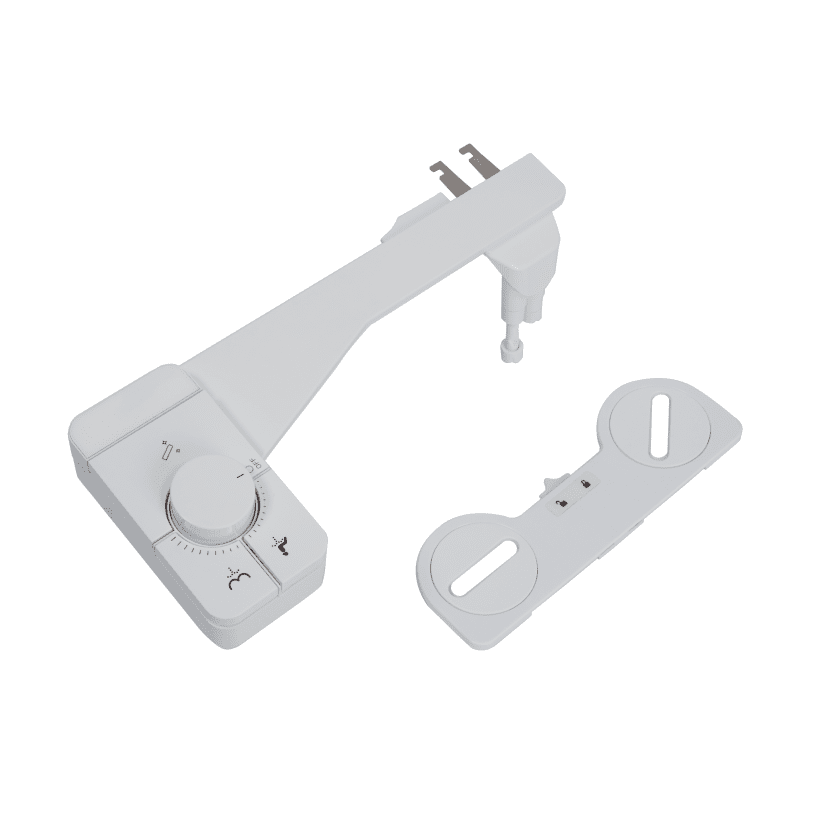

Bidets: Separate bidet fixtures, electronic bidet seats (add-on).

-

-

Bathroom Accessories & Décor:

-

Functional Accessories: Toilet paper holders, towel bars/rings/hooks, robe hooks, soap dishes/dispensers, tumblers, wastebaskets, shelves.

-

Décor & Comfort: Bathroom mirrors (simple, lighted, smart), bath mats/rugs, shower curtains/liners, window treatments, artwork, plants.

-

-

Bath Linens & Textiles:

-

Bath towels, hand towels, washcloths, bath sheets, bathrobes.

-

-

Lighting & Ventilation:

-

Bathroom-specific light fixtures (vanity lights, ceiling lights, sconces with appropriate IP ratings).

-

Exhaust fans/ventilation units.

-

-

Personal Care & Consumables:

-

Electrics: Electric toothbrushes, water flossers, hair dryers, straighteners/curlers (often stored/used in bathroom).

-

Consumables: Hand soap, body wash, shampoo, conditioner (though these are more FMCG, they are retailed in the same space).

-

3. Industry Chain Structure

Upstream:

-

Raw Material Suppliers: Providers of metals (brass, stainless steel, zinc), ceramics, glass, engineered stone (quartz), acrylic/solid surface, wood/MDF, plastics, textiles.

-

Component Manufacturers: Producers of valves, cartridges, faucet handles, shower hoses, glass panels, LED light modules, mirror substrates.

Midstream:

-

Product Manufacturers & Brand Owners:

-

Integrated Major Brands: Kohler, Moen, Delta (Masco), American Standard (LIXIL), TOTO.

-

Specialty & Luxury Brands: Waterworks, Kallista, THG Paris, Dornbracht.

-

Accessory & Décor Specialists: Umbra, Simplehuman, Rohl.

-

Private Label/Contract Manufacturers: Produce for large retailers.

-

-

Design & Development: Focus on trends (colors, finishes like matte black, brushed gold), ergonomics, and technological integration.

Downstream:

-

Distribution & Retail Channels:

-

Specialty Bath & Kitchen Showrooms: High-service, full-design offerings.

-

Home Improvement Retailers: Home Depot, Lowe's, B&Q (mass selection, DIY focus).

-

Department & Home Goods Stores: For accessories, linens, and décor.

-

Online Pure-Players & Marketplaces: Wayfair, Amazon, Build.com.

-

Direct-to-Consumer (DTC) Brands: Increasingly common, especially for accessories and décor.

-

Plumbing & Tile Supply Houses: Trade-focused.

-

-

Installation & Service: Professional plumbers, electricians, handymen, bathroom remodelers.

-

End Consumers: Homeowners, DIY enthusiasts, renters, interior designers, hotel/resort purchasers, facility managers.

4. Key Market Dynamics & Characteristics

-

High-Involvement, Infrequent Purchases: Consumers spend significant time researching for major fixtures due to high cost and long replacement cycles.

-

Strong Influence of Interior Design Trends: Highly sensitive to trends in colors, materials (e.g., mixed metals), and styles (modern farmhouse, minimalist, Art Deco revival).

-

Renovation & Remodeling Driven: A large portion of demand is not for new construction but for bathroom renovation projects, which are a top priority for home improvement.

-

Premiumization & "Spa-at-Home" Trend: Consumers are investing more to transform bathrooms into personal wellness retreats, driving sales of luxury finishes, freestanding tubs, and steam showers.

-

Blurring Lines with Technology & Wellness: The rise of smart mirrors, digital showers, and connected devices integrates tech into the core product offering.

-

Importance of Brand Perception & Trust: For plumbing fixtures, reliability and warranty are paramount. For décor, design and aesthetics lead.

5. Development Trends

-

Smart Bathroom Integration:

-

Voice & App-Controlled Showers: For personalized temperature/pressure presets.

-

Smart Mirrors: With anti-fog, integrated lighting, displays for news/weather, and health metrics.

-

Leak Detection & Automatic Shut-Off Valves: Integrated into faucet supply lines.

-

-

Wellness & Biophilic Design:

-

Products that promote relaxation: Airjet/Chromotherapy tubs, steam shower generators, and heated flooring.

-

Use of natural materials like wood, stone, and bamboo in vanities and accessories.

-

Plants and natural light integration as part of the product ecosystem.

-

-

Sustainability & Water Efficiency:

-

Low-flow faucets and showerheads that maintain performance.

-

WaterSense certified toilets and products.

-

Materials with recycled content and focus on durability and longevity to reduce waste.

-

-

Customization & Personalization:

-

Modular vanity systems with mix-and-match components.

-

Wide selection of finishes (e.g., matte black, brushed brass, chrome) for faucets and hardware.

-

Customizable lighting (color temperature, dimming) in mirrors and fixtures.

-

-

E-commerce & Digital Tools:

-

Sophisticated online configurators and visualizers to preview products in a virtual bathroom.

-

Growth of social commerce (inspiration on Instagram, Pinterest) driving discovery and purchase.

-

6. Major Challenges & Opportunities

Challenges:

-

Supply Chain Complexity & Cost: Global sourcing of materials and components, vulnerability to logistics disruptions.

-

Intense Competition & Price Sensitivity: Especially in the mid-market, with many brands and retailers competing.

-

High Returns & "Showrooming": Consumers researching in-store but buying online, and the logistical cost of returns for bulky items.

-

Rapidly Changing Consumer Tastes: Difficulty in forecasting trends and managing inventory for fast-moving decorative items.

-

Installation Barrier: The need for professional installation for core fixtures can be a deterrent and adds to the total cost for consumers.

Opportunities:

-

Aging Housing Stock in Developed Markets: A massive installed base of outdated bathrooms requiring modernization.

-

Growth of the "Prosumer": DIY+ consumers willing to invest in higher-quality products and undertake complex projects with guidance.

-

Bathroom as a Primary Home Wellness Hub: Opens new categories for tech-enabled, experience-driven products beyond basic function.

-

Emerging Market Development: Rising middle-class populations in Asia, Africa, and Latin America entering the market for modern bathroom products.

-

DTC & Niche Brand Growth: Ability to build loyal communities around specific design aesthetics or values (e.g., sustainability, artisan craftsmanship).

-320x320.webp)